Deciphering Navigational Warranties in Marine Insurance Contracts of Adhesion

“It is important and a necessary step in good business practices to have experienced Maritime and Admiralty Law counsel review any declinations provided by one’s marine insurance carrier. Expensive defense costs and legal fees, as well as millions of dollars of indemnity coverage, are often on the line.”

Contracts of adhesion are a sticky mess to avoid where possible. In some cases the language in these contracts creates a quagmire of confusing terms impossible to circumvent. These form contracts issued by one party to another on a take-it-or-leave-it basis, without the right of assignment to a third party, arise most frequently between insurance carriers and insured parties. “Owing to the fact that it drafted the language, the insurance carrier naturally creates advantages for itself and, whenever it can do so, it skillfully asserts that language to the carrier’s financial advantage (and the insured party’s detriment). The financial stakes can be quite large . . . .”Insurance carriers draft their policy contracts in a manner to guard against speculative risks or unexpected perils and exposures. The declaration page, the insuring agreement, the conditions, the exclusions, and the endorsements of a policy create an intricately structured relationship between the insurance carrier and insured party.

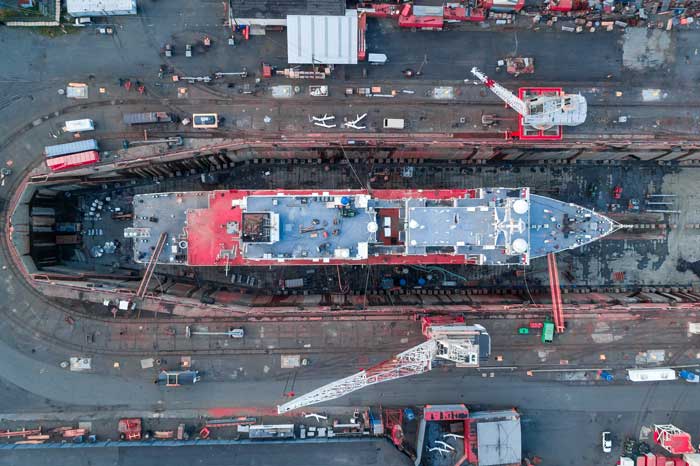

Owing to the fact that it drafted the language, the insurance carrier naturally creates advantages for itself and, whenever it can do so, it skillfully asserts that language to the carrier’s financial advantage (and the insured party’s detriment). The financial stakes can be quite large when, for example, the carrier and the insured party are at odds on the question of who pays the bill to repair the collision damage to this very large crude carrier (VLCC) tanker, the DALIAN VENTURE, damaged on November 5, 2013, in a collision in the Singapore Strait, shown here as she lies at a repair yard in Sembawang, Singapore.

Keith Michael Taylor/Shutterstock.com

Fortunately for the insured party, insurance carriers have not yet found the way to eliminate all ambiguities that can help the insured. The insured party who retains an attorney who is skilled in interpreting policy language and is a capable advocate can often force a carrier to reverse its declination of coverage and not only offer defense coverage for legal fees and costs (when the insured party becomes entangled in expensive lawsuits) but also to provide broader indemnity coverage that will pay the money damages that the insured party owes to the party that sued him.

Sky Cinema/Shutterstock.com

The law requires that our courts construe any ambiguity in an insurance policy to provide coverage for the insured. Any doubts regarding the breadth of coverage requires that the policy be interpreted in the way that affords coverage. For instance, undefined terms in a policy such as “repair” and “delivery” can result in a finding that a vessel’s physical departure from a shipyard does not constitute the meaning of delivery set forth in an insurance policy. Federal maritime law controls the interpretation of maritime contracts and, the application of this law, in combination with an understanding of maritime terminology and practices, can result in a reversal of a carrier’s declination of coverage.

One section of marine insurance policies often examined by our federal courts is the navigational warranty endorsement.

The language in typical navigational warranty is as follows:

WHILE AFLOAT, IT IS WARRANTED BY THE INSURED THAT ANY VESSEL COVERED BY THIS POLICY WILL BE CONFINED TO WATERS WITHIN A FIVE (5) MILE RADIUS OF THE INSURED LOCATION OR BOAT REPAIR FACILITY.

Suppose a vessel leaves a yard in Norfolk, Virginia, and during its travel to its final destination in South America the crew discovers in the Gulf of Mexico that repairs have become necessary. Does the navigational warranty exclude coverage simply because the vessel is more than 5 miles from Norfolk? The answer depends on whether the word “insured” in the last line describes just the insured’s principal place of business and normal base of operations. Under one interpretation, there is no coverage. Using the other interpretation, the insurance carrier must cover the insured party because, when the vessel pulls into a repair facility along the Gulf Coast of the United States, a new 5 mile radius now exists.

Consider the ship fire shown in the next photo:

SugaBom86/Shutterstock.com

Does the insured party lose coverage if the casualty occurred beyond five statute miles from “the insured location or boat repair facility”, but within five nautical miles?

An attorney skilled in interpreting policy language, and willing to stand up to the insurance carrier, can force the insurance carrier to extend coverage to the insured party – even after the insurance carrier told the insured party that the carrier would not cover the claim – because ambiguities (like these) can be used to the advantage of the insured party and because our federal courts recognize that ambiguities in the insurance carrier’s adhesion contracts must be read in a way that affords coverage to the insured party.

It is important and a necessary step in good business practices to have experienced Maritime and Admiralty Law counsel review any declinations provided by one’s marine insurance carrier. Expensive defense costs and legal fees, as well as millions of dollars of indemnity coverage, are often on the line.